- The Financially Independent PhD

- Posts

- 5 Buckets to Finally Control Your Money — No Extra Bank Accounts Needed

5 Buckets to Finally Control Your Money — No Extra Bank Accounts Needed

A rules-first money separation system you can use today — no matter what country or bank you’re in.

Most people think they need more income or a better salary to get rich.

Wrong.

The average person wastes 20–35% of their income every month because they don’t have a money flow system (U.S. Bureau of Economic Analysis, 2024).

That means they spend 3–4 months a year just to fund impulse buys, subscriptions you forgot about, and random Amazon dopamine hits.

Shocking!

But wealth doesn’t come from earning more. It comes from controlling the flow.

A system beats willpower. If you rely on “trying to spend less,” you’ve already lost.

Question is: What’s a simple money flow system that works for any income level?

The answer? The 5-Bucket Money Flow Model.

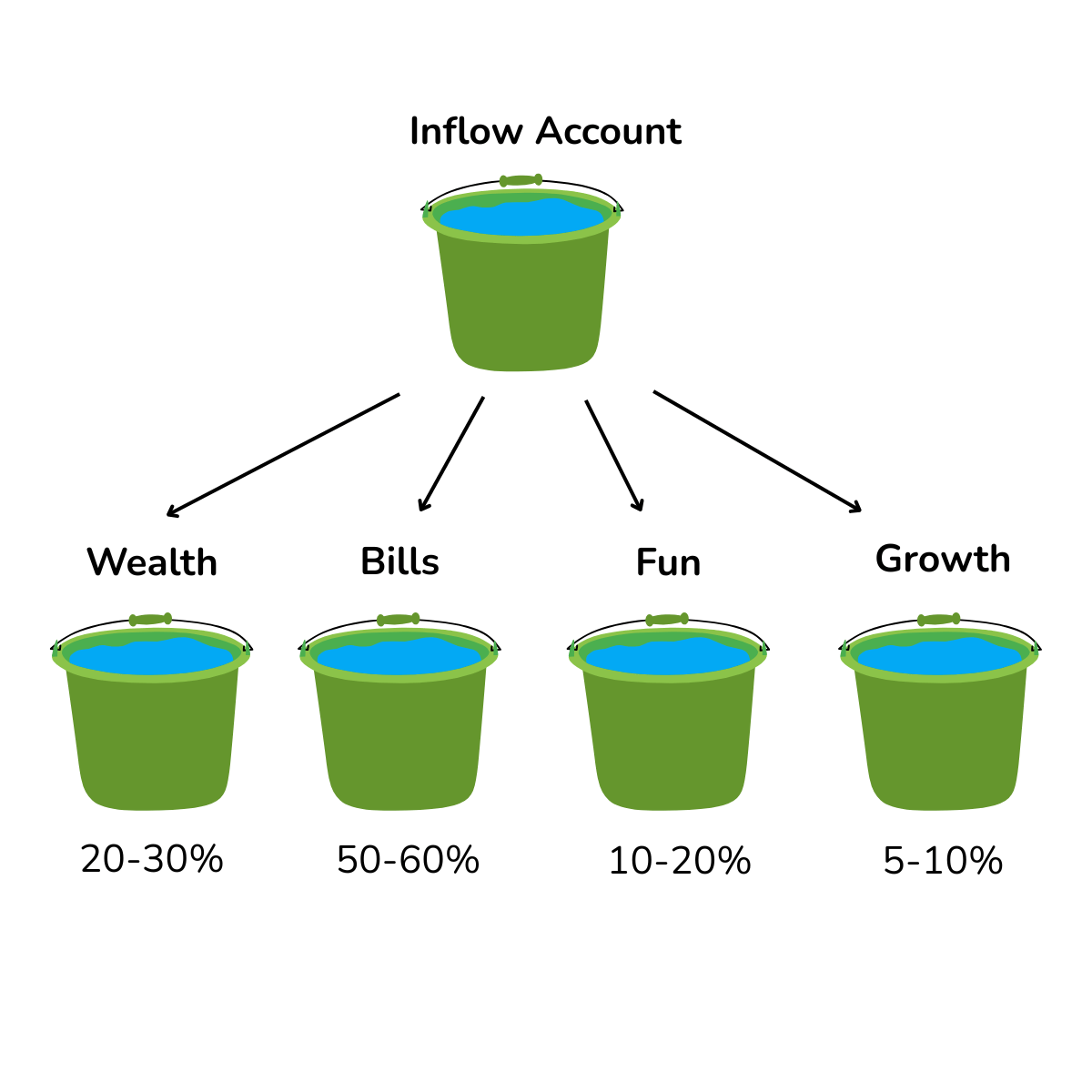

The 5-Bucket Money Flow Model

This model is a simple way to organize your money by dividing it into five key areas—a.k.a. buckets—so you can take control of your finances without feeling overwhelmed. It’s all about making your money work smarter for you!

Inflow Account (100% of income)

All earnings go here. Your paycheck, business income, freelance money — all goes into ONE central account. This is the mothership.

Rule: Never spend from this account directly.

Wealth Bucket (20–30%)

First thing out the door: investments, savings, emergency fund, retirement. Always pay yourself first. No exceptions.

Bills Bucket (50–60%)

Fixed essentials: Mortgage/rent, utilities, insurance, debt payments. Fixed, predictable, boring. The stuff that keeps you alive.

Fun Bucket (10–20%)

This is guilt-free spending. Dinner dates, vacations, hobbies. If you blow this, you’re not broke — you just wait until next month.

Keep in mind: when it’s gone, it’s gone.

Growth Bucket (5–10%)

Courses, coaching, books, skills. Pay attention: The benefits here grow faster than a trending crypto coin in a boom.

Before trying the buckets system I was the classic “smart broke” — making money, but leaking it like a busted garden hose.

No plan, no flow, just vibes.

After applying it, the first thing that happened was that my stress tanked. But also, my net worth started climbing, just from organization. This also allowed me to actually say yes to opportunities without panic.

How to Actually Separate Your Money Into Buckets (Even if Your Bank Won’t Play Nice)

Truth: The buckets don’t have to be real bank accounts — they just need to be real in your behavior.

Use budgeting apps that let you create “pots” inside one account. Track how much belongs to each bucket — even though physically it’s in the same account.

Pro Tip: The real power isn’t in the number of accounts — it’s in setting rules you don’t break. If you know exactly what amount of money goes in each bucket, you’ve won most of the game before it even starts

Until next time,

The Financially Independent PhD